Note: this is part of the 19th edition of our weekly newsletter, the Databyte. To receive it in your inbox, subscribe here.

The Reserve Bank of India releases data on the total credit disbursed throughout the country to various sectors every month.

One part of the credit is “food credit”: money loaned out to the Food Corporation of India. In May, 2020 the total aggregate borrowing by the FCI stood at Rs. 79,135 crore – high compared to historical standards, but not out of the ordinary. The FCI typically do not reach the Rs. 80-85,000 crore level until harvest seasons – Dec-Jan and June-July. However, FCI’s entire borrowings is less than 1% of the total credit.

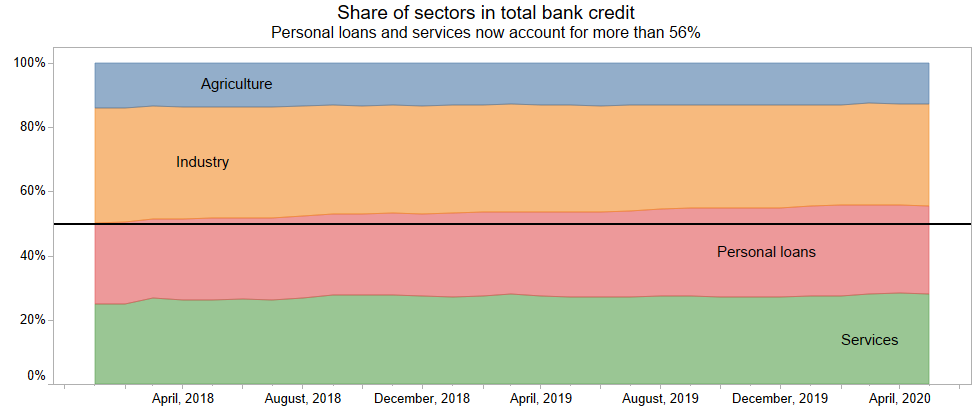

Segments among non-food credit are divided into major occupational groups: agriculture, industry (largely manufacturing), services and personal loans.

Credit to industry has been tapering for quite some time. This was even highlighted in the recent Economic Survey of 2019-20.

Just two years ago, the share of industry in total loans given was 36%. It’s fallen by 5%.

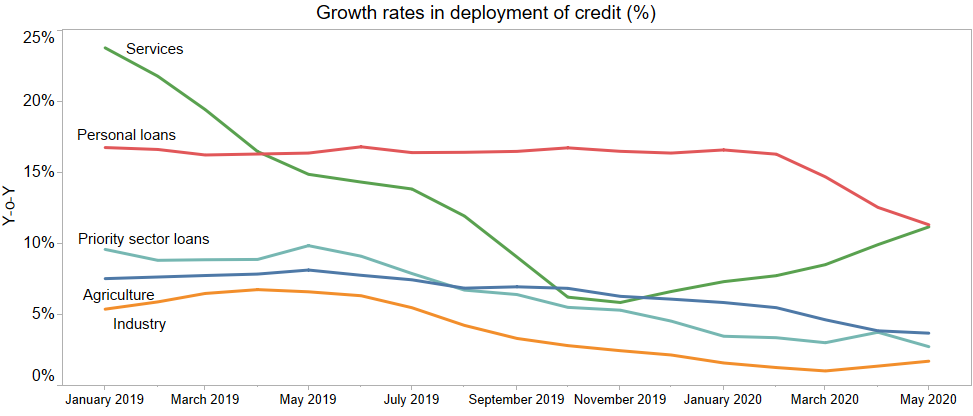

Credit to industry, was growing at just above 5% on a year-on-year basis till 2019. Additionally, agriculture lending has been stagnating for quite a while now.

However, to understand the crisis within bank credit, lending to priority sectors is a good measure. Advances to priority sector include agriculture, MSMEs, education, affordable housing, social infrastructure, renewable energy among others. Banks are mandated to lend approximately 40% of their adjusted bank credit to priority sectors. From January to May 2019, priority sector advances (PSA) were growing at 10% y-o-y. Since then, it has been on a freefall. As of May 2020, growth in PSA was just 3%.

However, there are two sectors that stand out: Personal loans and Services.

While the increase in lending to other sectors was moderating, personal loans grew steadily at 16-17%. Up till Covid-19. Since March, 2020, it’s growth rate has reduced to 11%.

At the time the Economic Survey 2019-20 was drafted, growth rate in loans to services was at an all-time low. It mentioned:

“The moderation in services sector growth during 2019-20 is also reflected in the high frequency indicators, though some recent data suggests that service sector activity might be bottoming out”

However, since then, lending to services sector has increased dramatically. While nowhere near the growth rates it had in early 2019, lending to services has been the only sector which has increased during Covid-19 from March to May, 2020.

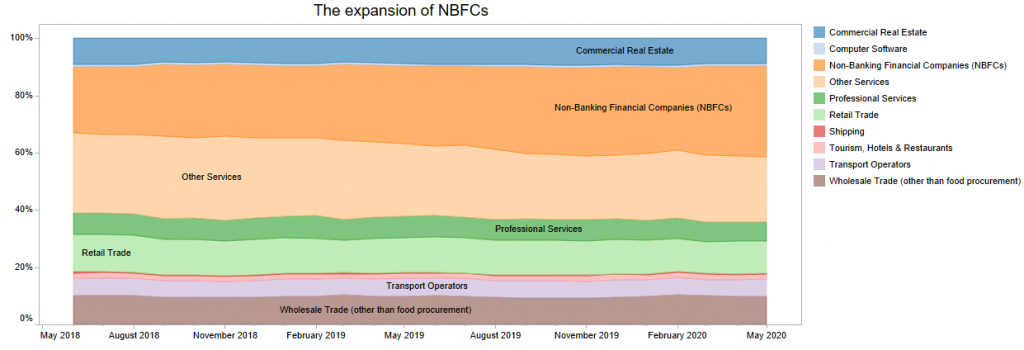

The expansion of NBFCs

For 15 states and UTs, service sectors now account for more than 50% of the Gross State Value Added (GSVA).

However, much of the increase in services lending has been on the back of lending to NBFCs and cannot be directly accrued to services. Scheduled Commercial Banks lend to non-Banking Financial Companies, who in-turn lend forwards. The share of NBFCs in advances to service sector has grown by close to 10% since 2018.

Download all data used for this edition here.

To get the Databyte in your inbox every Sunday, subscribe here.