11 auto insurers in the United States are either returning the monthly premiums or offering return credit to their policy holders. Among the largest auto-insurers, Progressive would provide around $1 billion back to personal auto consumers as most Americans will be staying off the road and off their vehicles.

In India, the Finance Ministry has extended the validity of third party motor policies with renewals due between 25 March- 14 April to 21 April.

In India, we do not have insurance companies dealing only with motor insurances. So, any gains accrued here would be typically balanced by the losses from other business segments. Insurance companies though, have seen an increase in the number of health insurance policies in March. Typically, sale of health insurance peaks in March (financial year ending), however, online insurers have seen an unusual spike they are attributing to the pandemic.

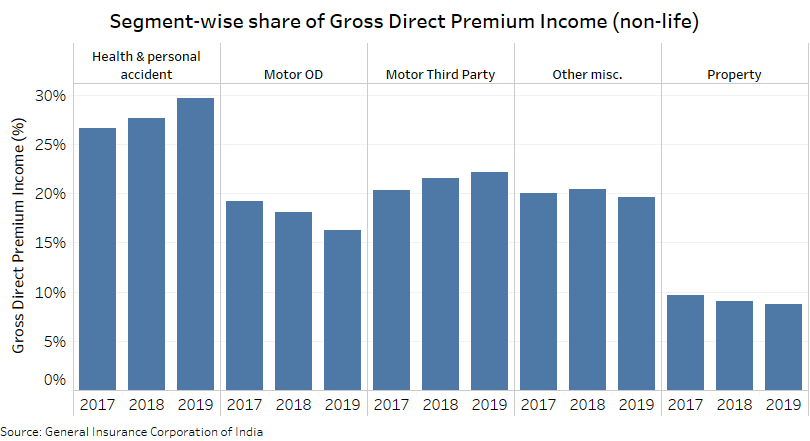

Personal lines of business, i.e. motor and health account for more than two-thirds of the non-life insurance premium for companies.

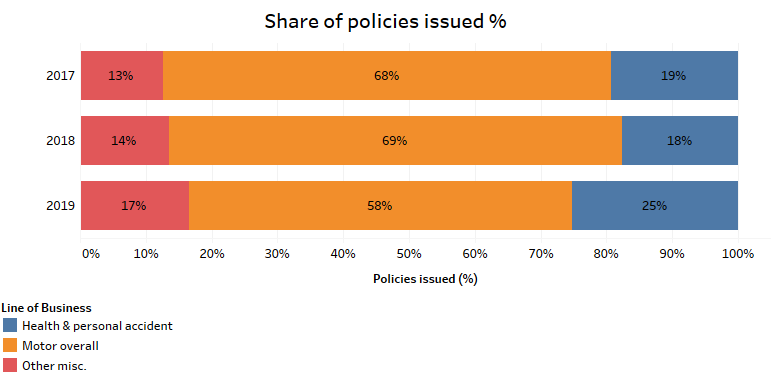

The number of motor insurance policies increased from 17.62 crores in 2017-18 to 19.05 crores in 2018-19.

However, its share (own damage + third party) in the total policies has decreased by more than 10%.

The national lockdown has been in place for more than 2 weeks now, and will most likely be extended till the end of the month. During this time, most of the private vehicles will see little to no movement, hence also reducing the accidents or damages and thereby, the number of claims. Even after lifting of the lockdown, the number of private vehicles on road will only increase gradually.

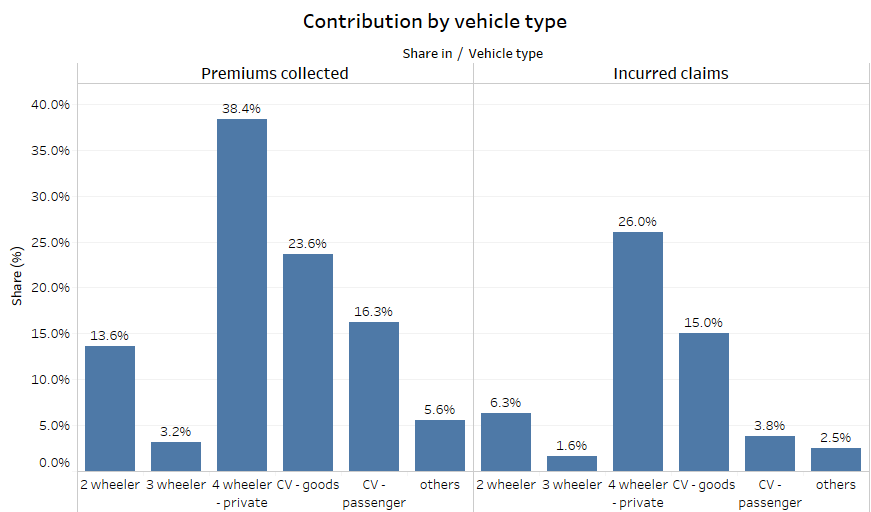

The contribution of private cars to the total premium collected on motor insurance is 38%, while its share in the amount of claims paid is 26%.

Combined motor insurance has a net incurred claims ratio of 81%, one of the healthiest among all the business segments. Incurred claims ratio is the percentage of claims paid by a non-life insurance company to the net premium earned. A ratio of claims settled to premium received. ICR above 100% indicates that for every premium collected, it pays out more than Rs. 100 as claims, thereby incurring losses. Insurance in the aviation sector has a net ICR of about 150%.

In the current year, there is likely to be no activity on this front in at least 30 of the 365 days. Assuming that claims are evenly spread throughout all the months of the year, the motor insurance companies will see a 6.6% reduction in the number of claims. That gives them an unexpected windfall of 2,376 crores.

But, these are back of the envelope calculations. In the market we currently live in, I would rather my insurer remains solvent to pay my claims rather than give away gains such as these. Additionally, motor insurance in India is handled way differently than in the US. In the US, the premiums are aligned more directly with usage, while in India, they are more proxy-driven. Where premiums are priced by usage, the release becomes more straight forward.

[activecampaign form=51]