Note: this is part of the 22nd edition of our weekly newsletter, the Databyte. To receive it in your inbox, subscribe here.

Among the slew of activities that were disrupted and brought to a halt since the nation-wide lockdown, there were a handful that continued to run uninterrupted. One among them was Indian Railways ferrying goods.

While the lockdown disrupted movement of goods across most sectors, railways continued to facilitate the transport of goods across the country. Indian Railways ferries a wide basket of goods – including food grains, fertilizers and industrial outputs such as coal, iron ore and cement among others.

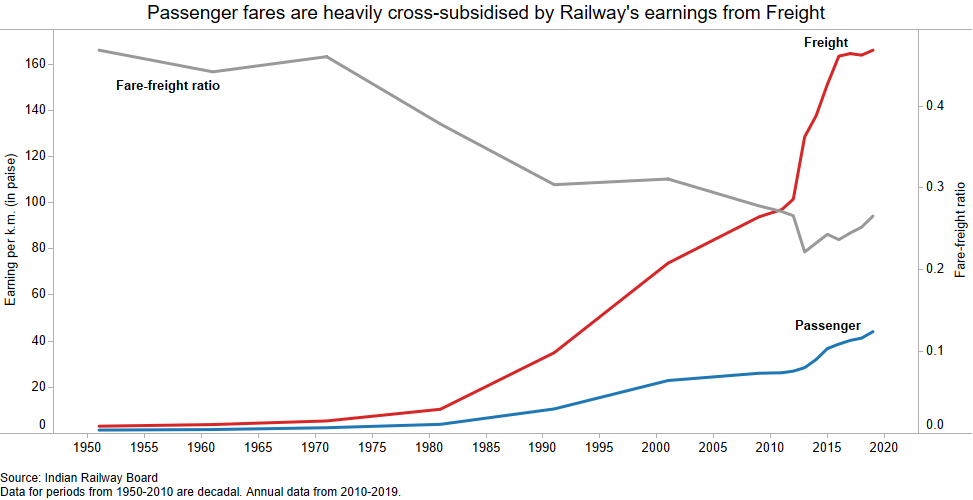

From the Railways standpoint, revenue earned from freight transport is critical – it amounts to more than 60% of its total gross revenue. In fact, Railways since inception has been cross-subsiding passenger fares from its earning from goods transport. For every ton of freight it transports a kilometer, the IR earns about Rs. 1.66, as compared to Rs. 0.44 (44 paise) to transport a passenger every kilometer.

To an extent, cross-subsidizing passenger fares by freight earnings is a feature of almost all public railways throughout the world. The point of difference is its extent. To measure this, there’s an indicator called the fare-freight ratio – the money earned moving a passenger by one kilometer versus the money earned moving a ton of freight by one kilometer. A low fare-freight ratio indicates a higher cross-subsidy.

After a state of constant decline since 1970s, the fare-freight ratio has finally started increasing.

Because of the nature of the cross-subsidy, freight volumes and earnings are extremely important for the Indian Railways. It has a direct impact on the financial health of the national transporter measured by the Operating Ratio – the amount spent on every rupee earned. As of March 2020, this stood at 98.4%. This has been the worst ever operating ratio the IR has posted in its existence – it spend Rs 98.4 for every Rs. 100 it earned.

However besides its financial health, freight volume and revenues are an important indicator of the health of the economy. When measuring how the economy is creeping back to normal, data on freight transport serves up as an excellent indicator given the wide varieties of commodities being transported.

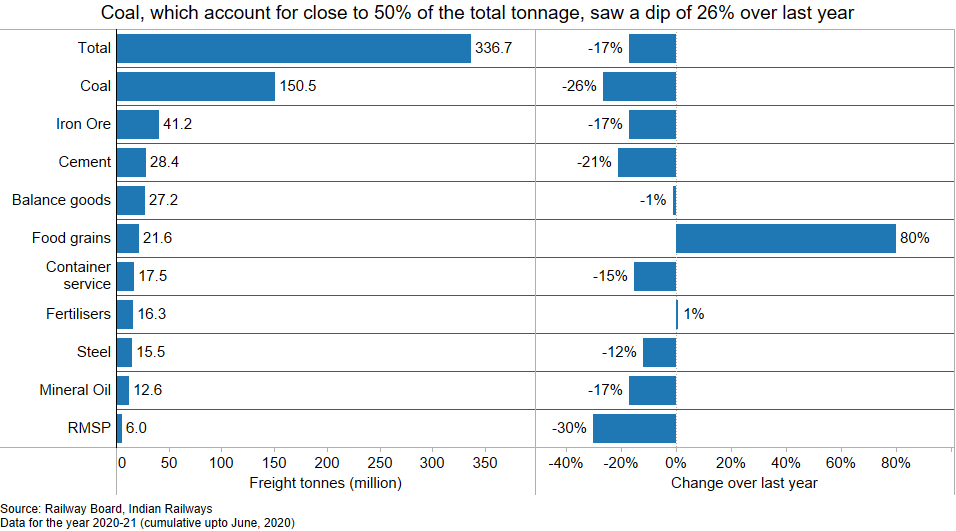

As of July 2020, the total freight tonnage decreased by 17% over last year. Among all the commodities it transports, coal accounts for close to 50% of the total tonnage. Compared to this time last year, the total freight volume for coal being transported has decreased by 26%. This decline is only next to raw material used for steel plants, which saw a decrease in freight tonnage by over 30%. A stand-out commodity though has been food grains. The Indian Railways already transported a bulk (85%) of the food grains procured by the Food Corporation of India. However, with the disruptions of road and logistical supply chains owing to the nation-wide lockdown, the transported 80% more food grains compared to last year, largely by running new “Annapurna trains“.

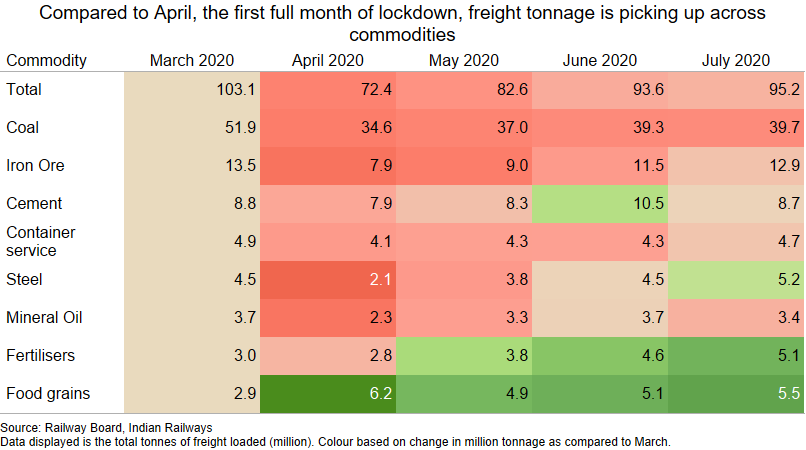

Since March, commodity freight volumes have been inching back to normal, albeit at a pace slower than what we would like. Coal tonnage is still 23% lower than what it was in March, a month which saw the initiation of the nation-wide lockdown and shutting of shops and businesses. The other commodities though still far from their levels in the past year, are close to what they were in March. One exception is fertilizers, which recorded 1% higher tonnage over last year, and 70% more over March (understandably so, given the Kharif season). What this does point is that despite laggard growth in industrial commodities, fertilizers and by extension the farm economy may be quicker to recover.

It would be interesting to drill deeper into the data, and see how private businesses and PSUs have fared in terms of booking freight volumes. Perhaps, the subject of a future edition.

Railways freight volumes and revenues are important for the financial health of both, Indian Railways and the economy. While these small signs of recoveries may bear some good news, a large challenge still remains at hand.

Revenues from freight operations fetch the IR close to 60% of its total earnings. A significant portion of the remaining 40% is passenger fares. The railways had already suspended all its regular passenger trains till the 12th of August. Last week it announced that the trains will remain suspended till further notice. All, but 230 special passenger trains will remain off the tracks for the foreseeable futures. Most of these 230 trains running are also running at only 70-75% occupancy. Clearly, beyond the 4000+ Shramik Special trains that ran from May 1 to July 9, people are unwilling to travel. And till the time it remains so, the Indian Railways will struggle for revenues.

Apart from being an IR problem, it also represents a challenge for the country and the economy. Close to 63 lakh migrants were ferried to their respective home states post-lockdown. The economy will begin to crawl back on track only once they have the modes to return back to their work place, are safe to do so and are willing to do so.

To get the Databyte in your inbox every Sunday, subscribe here.