Note: this is part of the 16th edition of our weekly newsletter, the Databyte. To receive it in your inbox, subscribe here.

With a recession breathing down on our necks, the automobile industry was already in a lurch before the Coronavirus pandemic. With mandatory BS-VI norms kicking in from April 2020, the auto-makers were struggling to sell their BS-IV stock.

But the pandemic and the nation-wide lockdown brought the industry to a screeching halt.

As we’ve written before in a previous edition, “Why Bangalore has more traffic than Delhi and Mumbai”, vehicle sales in India are measured at two-points.

- Factory-gate sales, which measures the number of automobiles leaving the factories to the dealerships.

- Retail sales or vehicle registrations, which measures the number of vehicles bought and registered by the dealerships.

With a nation-wide lockdown in place, data from brokerage reports estimate a 29-71 percent drop in factory-gate shipments for passenger cars, two wheelers and commercial vehicles.

With the lockdown being eased in several parts of the country, we looked at retail sales or vehicle registrations, and it shows some green shoots of recovery.

Total non-transport vehicles (vehicles used for purposes other than commercial transport) registered in the initial 10-12 days of June, 2020 stood at 6,37,896, a 165% increase over the previous month. Transport vehicles registered a 233% increase, with the total registrations at 27,963.

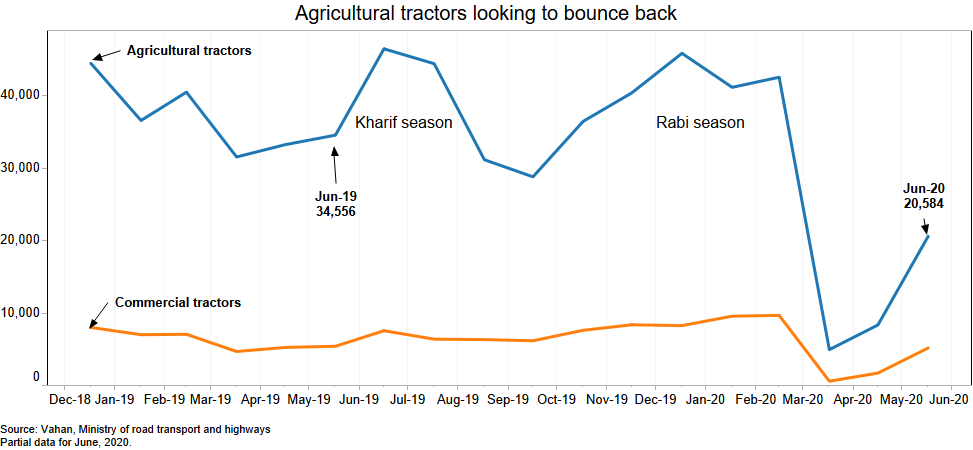

The data on sale of vehicle registrations is covers a lot. Apart from just automobiles, it also has data on auto equipment used in manufacturing, agriculture and construction. These are good indicators to understand how a particular sector is doing. For a long time, tractor sales have been used as a proxy to measure how the rural agro-economy.

To measure recovery in sales, we compared the vehicle registrations of the months in 2020 to the corresponding months of 2019. Across vehicle categories in March 2020, which saw nearly a week of lockdown, the vehicle registrations were 125% of March 2019, or 25% more than the previous year. In April, the first full month of lockdown, registrations were only 22% of 2019, further falling to 12% in May, before recovering to 36% in June.

This recovery has come on the back of a few categories of vehicles – notably agriculture and construction. Automobiles used in agriculture range from tillers, harvesters to specialized trailers and tractors. Sales in agriculture vehicles was stagnating at the start of the year, with year-on-year sales in January-March, 2020 barely above the previous year. With that context, sales in just the 10-12 days of June crossing 60% seems a good recovery figure.

Vehicles used in construction include excavators, rollers, crane mounted construction equipment and more. These have recorded a 44% recovery to the June 2019 figures. Personal transport vehicles which account for more than 80% of the total vehicles registered, also saw registrations touching close to 37% of June 2019.

It’s a different story altogether for commercial goods carriers and passenger transport vehicles. Both these categories saw a healthy growth in the period ending March before the lockdown, but failed to post recoveries in June.

As we’ve mentioned before, for long, analysts have used tractor sales to track the rural agro-economy. However, as the sowing and harvest season approach, manufacturers would start dumping tractors and other equipment to retailers to drive up their sales figures. Hence, any analysis of factory-gate sales figures would be inaccurate and with a lag. On the other hand, actual vehicle registrations offer better, real-time insight into how the sector is actually faring.

With the advent of the south-west monsoon and the beginning of the Kharif season, crops are sowed from May to July with harvest beginning from September onwards. For Rabi crops, sowing begins from October with harvest for February onwards.

While other transport and non-transport vehicles typically see higher sales during Diwali and other festive seasons, tractor and agricultural sales follow the Kharif and Rabi season. Sales peak during July-August and January-March. In June 2020, agricultural tractor sales were 60% of the figure in June 2019.

Mahindra and Mahindra, one of the biggest players in manufacturing agricultural tractors, posted a 2% year-on-year increase in factory sales for May. This is inclusive of domestic as well as export numbers. The coming months of July and August will be critical to understand how the recovery post-lockdown for rural markets will look like.

To get the Databyte in your inbox every Sunday, subscribe here.