Note: this is part of the 15th edition of our weekly newsletter, the Databyte. To receive it in your inbox, subscribe here.

True story this.

In November of 2014, when we decided to become first-time entrepreneurs with How India Lives, we went about registering a company. A chartered-accountancy firm known to one of use helped out. It took us close to two months to complete the process.

Part of it down to our first-time behavior and the process involved. Part of it down to an official in the Ministry of Corporate Affairs, who kept rejecting our company names, citing rules like these.

After much agony, it got done, but we ended up with a company name that wasn’t really intended and which one of use can live with and two of us have no choice but to live with.

A delightful irony: the official who kept rejecting our first-choice to 50th choice names shares his name with the second-most famous Communist in history.

Since then, it’s become easier and faster to incorporate a company in India. The government pursued this goal as a sub-set to improve India’s position in the World Bank’s ease of doing business rankings. Today, practically speaking, everything can be done within a week. It can be done online, including checking the availability of a name.

So, technically, when India shut down for the coronavirus, it was still possible to register a new company. But, did that happen?

First, some numbers for context.

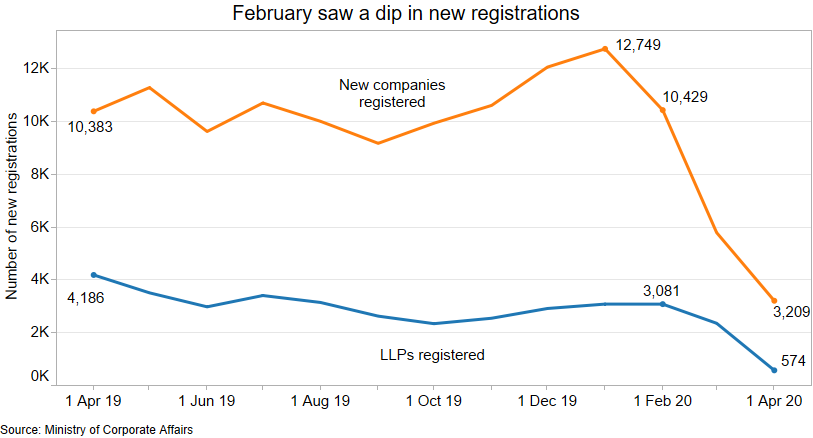

In April of 2019, about 14,500 new companies and partnerships were registered. Over the next 11 months, the monthly average of new companies and partnerships being registered was 13,700.

Come to March 2020, when about a week was lost, and this number dropped to 8,144. In April 2020, the first full-lockdown month, this figure of incorporation plummeted to 3,783 – a drop of 72%. Put another way, for every four companies/partnerships formed in April 2019, only one was formed in April 2020.

But, why does this matter?

The incorporation of new companies is one measure of how an economy is faring. It’s a forward-looking statement from entrepreneurs and the level of risk they are prepared to take with their money, time and choices. In 2018, India was ranked ninth on the number of new companies incorporated.

Sure, companies are formed for all kinds of reason. Some, not so good. There are companies that exist purely to provide a legal shelter for illicit movement of funds, divert funds, and to convert black money to white.

But equally, there are those that are all about the leap of faith that is entrepreneurship. They are a signal of what risk capital is thinking.

Judging by these numbers, risk capital wasn’t feeling enthused. It wasn’t March, when the shadow of coronavirus descended. And it wasn’t April when it started to overwhelm.

It was February. That’s when the lines for both new companies and limited liability partnerships (LLPs) – the latter being an institutional structure requiring lower levels of regulatory compliance – started moving down.

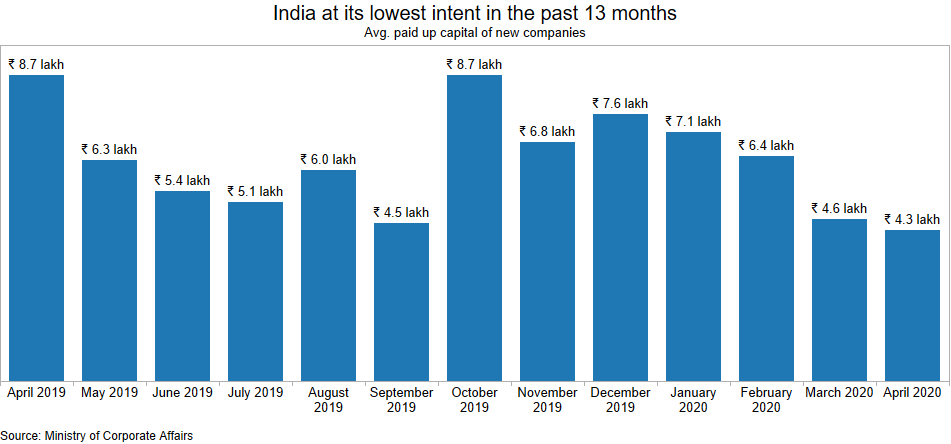

But one should also look beyond the number of new companies. One of the things to look at is the paid-up capital, which is the actual money initially invested into the company by its promoters. These are their own funds. More than the number of companies incorporated, this is a more authoritative sign of whether they mean business or not. The greater the amount they channel into the companies they have formed, the greater the potential intent.

Since December 2019, the monthly average paid-up capital of new companies incorporated has been on the decline. In April, it was the lowest in the past 13 months. Yes, April was an extraordinary month due to the pandemic. But what this number is saying is that even among companies that went ahead and registered (the process is online) in this pandemic month, the average investment was lower than usual.

Of the 125,929 companies (we are excluding partnerships here) that have been incorporated in India during the 13-month period to April 2020, a majority were in the services sector. This includes various kinds of business services, various kinds of community services, finance and insurance. This was followed by manufacturing and trading.

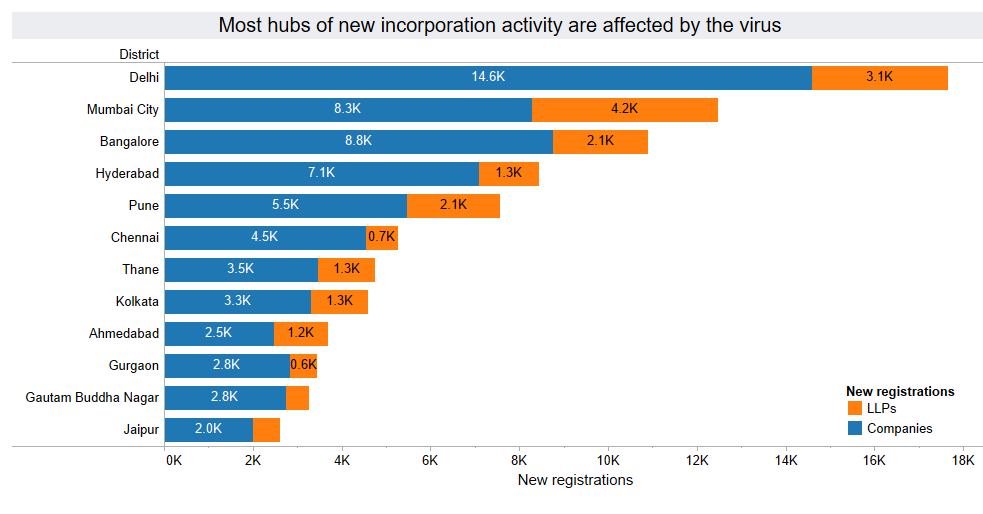

During this 13-month period, eight states accounted for nearly three-fourths of all companies and LLPs formed. In descending order of share, these are Maharashtra, Delhi, Uttar Pradesh, Karnataka, Telangana, Tamil Nadu, Gujarat and West Bengal. Even among them, Maharashtra and Delhi account for nearly one-third of new entities.

Break it down further to cities, and the concentration of economic activity in a few cities becomes apparent. It’s a matter of even greater concern given that most of these hubs of new company activity are acutely affected by the pandemic. Even when they have opened for business, in different degrees, the virus is spreading here at an alarming pace.

Delhi and Mumbai, the two cities most ravaged by coronavirus, accounted for about 18% of new companies registered and about 20% of new LLPs registered.

If April was a month of hope, May and June have turned into months of reckoning. As the economy has reopened, businesses are getting their first sense of what a recovery might be like. And it’s not looking good. June and July will give a sense of where the new normal might be. We’ll come back to this number in a future edition of this newsletter.

To get the Databyte in your inbox every Sunday, subscribe here.