Note: this is part of the thirteenth edition of our weekly newsletter, the Databyte. To receive it in your inbox, subscribe here.

On Friday, the government released data on the economy’s performance in the last quarter of financial year 2019-20.

It made for grim reading.

Even with just one week of a Corona-induced shutdown, GDP (gross domestic product) growth was a sluggish 3.1%—the slowest in 12 years. The Indian economy was slowing even before Corona ground it to a halt.

If that was a trickle of red, another set of numbers released a fortnight ago showed a sea of red.

These were the export-import numbers for the month of April—the first full month when the economy was in a freeze due to the Coronavirus.

It told us that the export of goods by India was down 60% compared to April 2019: against $26 billion, just $10.4 billion was done. Similarly, import of goods into India was down 59%.

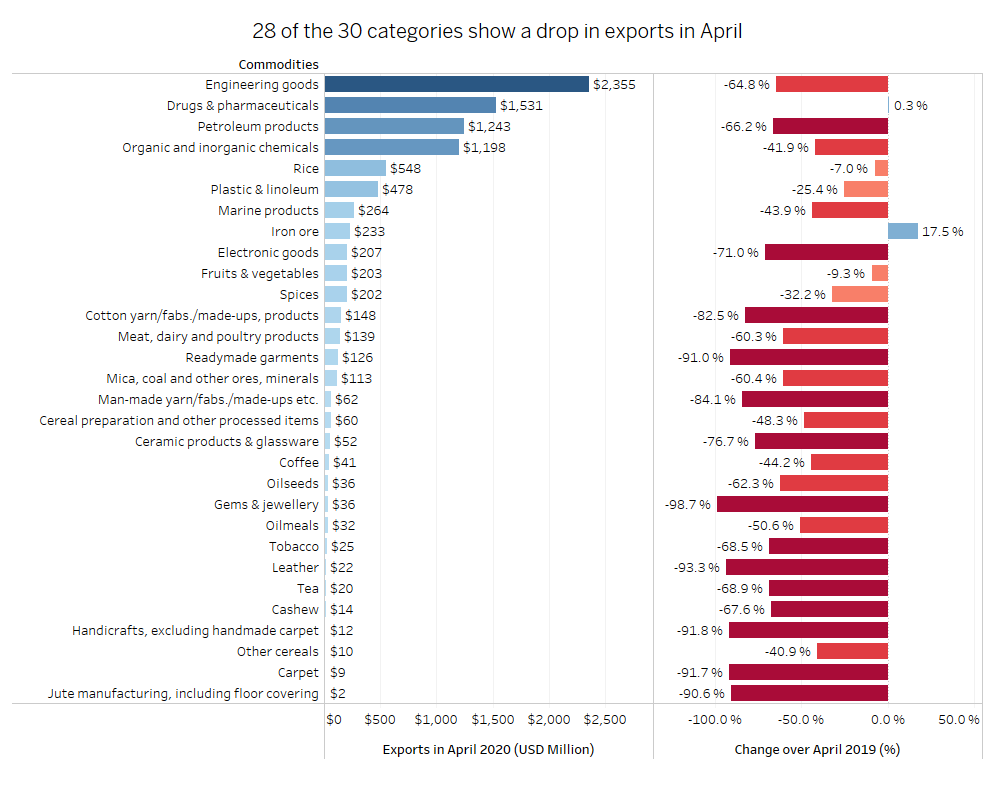

The graphic below shows what happened in April 2020 in the 30 commodity groups that make up Indian exports. Among the top 10 by value, only two survived the carnage: pharmaceuticals and iron ore. And the losses were limited in rice, and fruits and vegetables.

As the economy reopens, as the lines of business start moving again, the extent and shape of recovery in foreign trade will be one to track. Because in this case, it’s not just a matter of getting a consignment to a port inside your own country, there’s also the additional dynamic of sending it to another country.

Into all this comes China, a country that didn’t get much love from the rest of the world. Even less so as the country where the virus has changed life as we know it originated.

India has its own thing going with China. There’s the standoff on the Line of Actual Control (LAC) in Ladakh. There’s the backing that India gave in the United Nations to explore China’s role in the spreading of the Coronavirus. And there’s a mission cry of self-sufficiency that has gone out from the ruling dispensation.

During a crisis that has placed a premium on countries having the wherewithal to combat it by themselves, this cry has been about reducing dependence on the world for finished products, intermediate products and raw materials. Instead of buying from the rest of the world, become a supplier to the rest of the world.

Although not stated, the overwhelming image is the ‘made in China’ tag that is imprinted on a range of goods from mobile phones to ballpoint pens. Beyond perception, nowhere is the trade challenge of this ambitious call more amply framed than the foreign trade in goods (as opposed to services) with China.

Let’s break down these numbers.

China is India’s third-largest export market for goods. In the 10 months between April 2019 and January 2020, it accounted for 5.5% of India’s exports. More importantly, India’s imports more goods from China than any other country. In this period, China’s share in India’s imports was 14.3%. This was nearly twice as much the next country (the US, 7.54%)

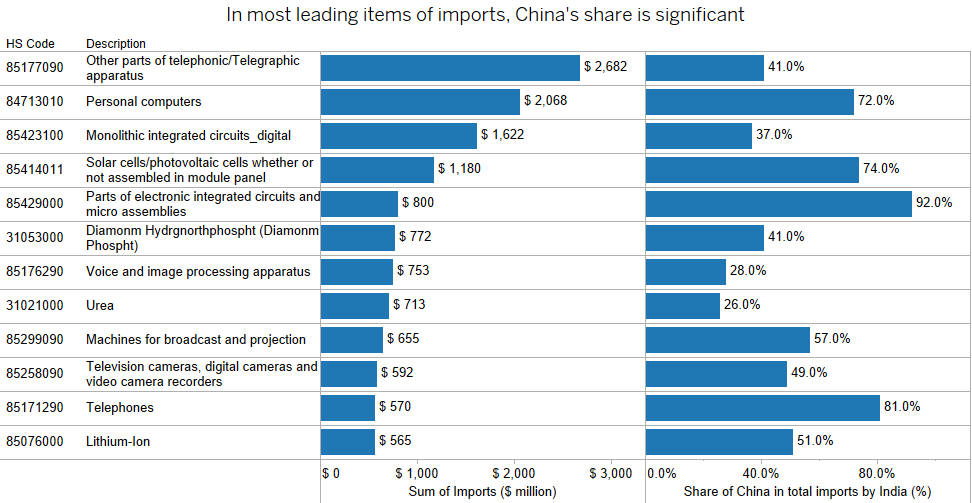

India’s import basket from China comprises across the value chain: finished products to intermediates to raw materials. There’s also a significant technology component to it, with mobile phones, computers and integrated circuits comprising a large part. Also, dependent on China are India’s solar-power plans.

In the top 12 items of import from China, each of which amounted to at least half a billion dollars in this period, the share of China in India’s total imports for that item stood at anywhere between 26% and 92%. That’s significant at the lower end of the band. At the upper end, it’s virtually indispensable.

At the very deep end, that’s the kind of import substitution India is aiming for. One measure of global competitiveness is how India’s share in world exports has moved. According to the government’s numbers, India’s share in world’s goods exports was 1.65% in 2011. In 2018, this was 1.67%.

In the same period, though, India’s share in exports of services (think, Indian IT) has increased from 3.18% to 3.54%. Gains in goods at the global level, of the nature of becoming self-sufficient domestically and becoming a supplier to the world internationally, won’t come easy.

Looking for data on the exports and imports of India by commodities and country? Head on to Gram.

To get the Databyte in your inbox every Sunday, subscribe here.