Note: this is part of the second edition of our weekly newsletter, the Databyte. To receive it in your inbox, subscribe here.

Late Friday night, the Reserve Bank of India, announced that it was superseding the Yes Bank board flagging governance issues. The bank was placed under a moratorium with withdrawal capped at Rs. 50,000 per depositor till the moratorium is in place. The next day the government announced a restructuring plan with the state-owned lender, SBI willing to pick up 49% stake in the bank.

For the longest time, many knew that the bank was on a life-support. But, it is difficult to realize the implications of India’s fourth largest bank going down. More so, Yes Bank had been one of the early adopters of UPI, accounting for 39% of all UPI transactions within the country. It achieved this scale forging partnerships with fin-tech companies left, right and centre. One of them, Phone Pe happened to be India’s largest and most valuable fin-tech company with more than 200 million registered users.

To ensure that all depositors don’t transfer money out of their account, Yes Bank shut down their banking transaction API. No UPI, no RTGS, no NEFT and long lines in front of the ATMs. Memories of November 8, 2016.

Phone Pe’s struggle to get its services up and running were widely covered, but this moratorium would have even a worse effect on small and medium businesses, operating without resources at hand like a Phone Pe.

To understand the scale of operations affected, NEFT transactions in January this year through Yes Bank were almost equal to 20% of those at HDFC Bank or SBI, two of India’s largest banks.

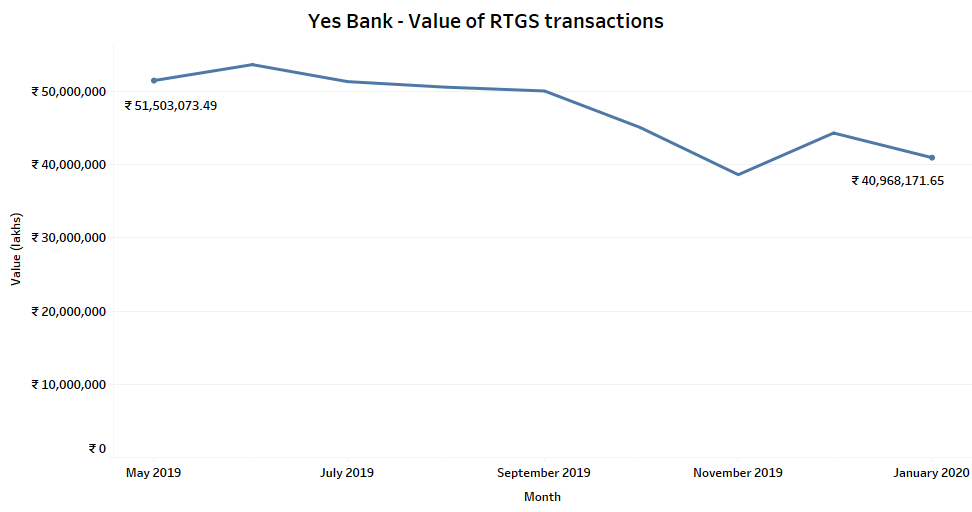

But, curiously, its transaction value has been declining steadily over the past quarter unlike other banks. The value of its Real Time Gross Settlement Systems transactions dropped 20% since May last year.

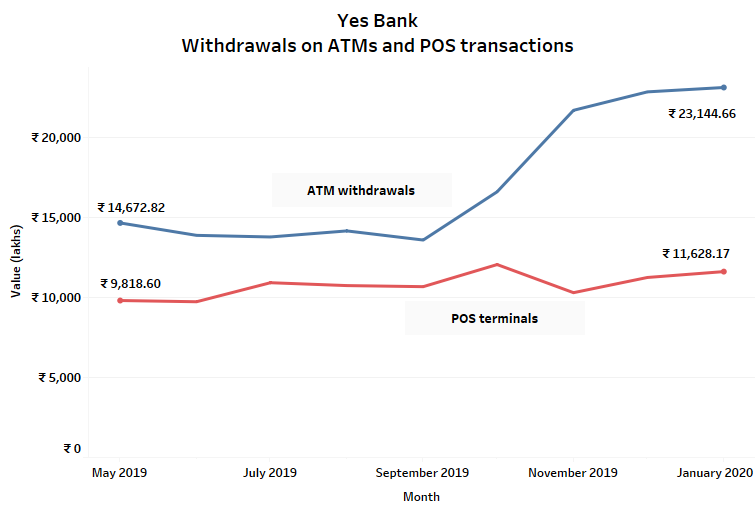

On the other hand, retail transactions in the form of withdrawals via debit and credit cards saw a surge. ATM withdrawals were up 60% since May last year.

While there are no spikes or dips in the transaction values from POS terminals, a moratorium on transactions will affect the retailers who have a single bank account of Yes Bank linked to their POS terminal at their business.

In other news

This week, our work featured in the Long Story section of Mint, where we looked at what was at risk because of the Coronavirus. Which Indian states lagged in public health infrastructure? How much of the international market has been put on hold? How much trade does India do with some of the worst- affected countries? With some cool graphics and illustrations, read here.

While salaries were increased for IIM graduates, the changing composition of top recruitment companies is yet another indicator of the economic downturn. How so? Read our story analysing IIM placements across India and abroad in Hindustan Times.

In 2014 when the government was sworn in, it made big gains in reducing the time and cost overruns of large-ticket infrastructure projects. Come 2019, it has squandered most of these gains made. Our data story on the big-ticket infra in Mint.

[activecampaign form=51]